FAQ: Should I increase the limits on all cars which I own?

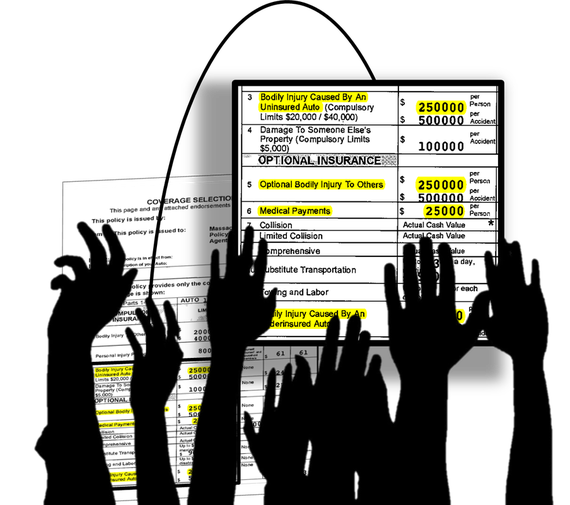

Yes, we recommend you do and here is why. Assume you own and insure two cars in your name. One car is insured with increased optional limits for Uninsured and Underinsured Motorist Coverages of $250,000 per person. Your other car is only insured for the minimum $20,000 per person for each of these coverages. Now assume you are injured by an Uninsured or Underinsured motorist while you drive the car with the minimum $20,000 per person limit. You will be prevented from making a claim against the higher $250,000 limit on your other car. In this example, you could only make a claim against the $20,000 of Uninsured or Underinsured Auto coverage on the car you were operating.

We first wrote about the different Parts of car insurance policies in our article Got “Full” Coverage. Most people are surprised to learn that Uninsured and Underinsured coverages even exist under Parts 3 and 12 of their Massachusetts personal auto insurance policies. This article is part of a recurring series about these little known Parts. There are many complexities and nuances to fully understanding these coverages. Email us with your own auto insurance questions – if you are not sure about something, chances are it may be a “Full” Coverage FAQ” to be answered in an upcoming issue.

- Steven M. Ballin, Esq.

Yes, we recommend you do and here is why. Assume you own and insure two cars in your name. One car is insured with increased optional limits for Uninsured and Underinsured Motorist Coverages of $250,000 per person. Your other car is only insured for the minimum $20,000 per person for each of these coverages. Now assume you are injured by an Uninsured or Underinsured motorist while you drive the car with the minimum $20,000 per person limit. You will be prevented from making a claim against the higher $250,000 limit on your other car. In this example, you could only make a claim against the $20,000 of Uninsured or Underinsured Auto coverage on the car you were operating.

We first wrote about the different Parts of car insurance policies in our article Got “Full” Coverage. Most people are surprised to learn that Uninsured and Underinsured coverages even exist under Parts 3 and 12 of their Massachusetts personal auto insurance policies. This article is part of a recurring series about these little known Parts. There are many complexities and nuances to fully understanding these coverages. Email us with your own auto insurance questions – if you are not sure about something, chances are it may be a “Full” Coverage FAQ” to be answered in an upcoming issue.

- Steven M. Ballin, Esq.

RSS Feed

RSS Feed